Post Title: Key Deadlines for Forms 1099-MISC and 1099-NEC: Stay Ahead of Your Tax Obligations As we usher in the new year, it’s time to start thinking about our tax obligations. Many businesses and individuals are familiar with the forms 1099-MISC and 1099-NEC. These forms play a crucial role in reporting payments made to non-employees and independent contractors. To ensure compliance with the Internal Revenue Service (IRS), it’s important to be aware of the upcoming deadlines for filing these forms.

2021 Deadline for Forms 1099-MISC and 1099-NEC

The first deadline to mark on your calendar is January 31, 2022. This is the due date for filing both forms 1099-MISC and 1099-NEC. Whether you are a business owner or an individual paying for services rendered, it is essential to provide accurate information and submit these forms on time.

Filing these forms helps the IRS keep track of payments made to non-employees, ensuring that everyone pays their fair share of taxes. It’s worth mentioning that the 1099-NEC form was reintroduced for the tax year 2020, separating the reporting of nonemployee compensation from the traditional 1099-MISC form.

Filing these forms helps the IRS keep track of payments made to non-employees, ensuring that everyone pays their fair share of taxes. It’s worth mentioning that the 1099-NEC form was reintroduced for the tax year 2020, separating the reporting of nonemployee compensation from the traditional 1099-MISC form.

The New 1099-NEC Form in 2021

A significant change that occurred in 2021 was the reintroduction of the standalone 1099-NEC form. This form is specifically designed for reporting nonemployee compensation. The purpose of this separation is to streamline the reporting process and avoid any confusion between payments made to independent contractors and other types of income reported on the 1099-MISC form.

By using the 1099-NEC form, businesses and individuals can accurately report the payments made to freelancers, consultants, and other non-employees. It is important to note that the 1099-NEC form must be filed separately from any 1099-MISC forms you may be required to submit.

By using the 1099-NEC form, businesses and individuals can accurately report the payments made to freelancers, consultants, and other non-employees. It is important to note that the 1099-NEC form must be filed separately from any 1099-MISC forms you may be required to submit.

2023 Tax Forms

Looking ahead, it’s prudent to stay informed about upcoming changes. Although it may seem far off, it’s essential to know that by tax year 2023, there may be modifications to these tax forms. Remaining up to date on these changes will help you avoid any penalties or discrepancies in reporting your payments to non-employees.

As the year progresses, make sure to keep an eye out for any updates or changes to the requirements for filing forms 1099-MISC and 1099-NEC. Staying proactive will ensure that you meet your tax obligations accurately and in a timely manner.

As the year progresses, make sure to keep an eye out for any updates or changes to the requirements for filing forms 1099-MISC and 1099-NEC. Staying proactive will ensure that you meet your tax obligations accurately and in a timely manner.

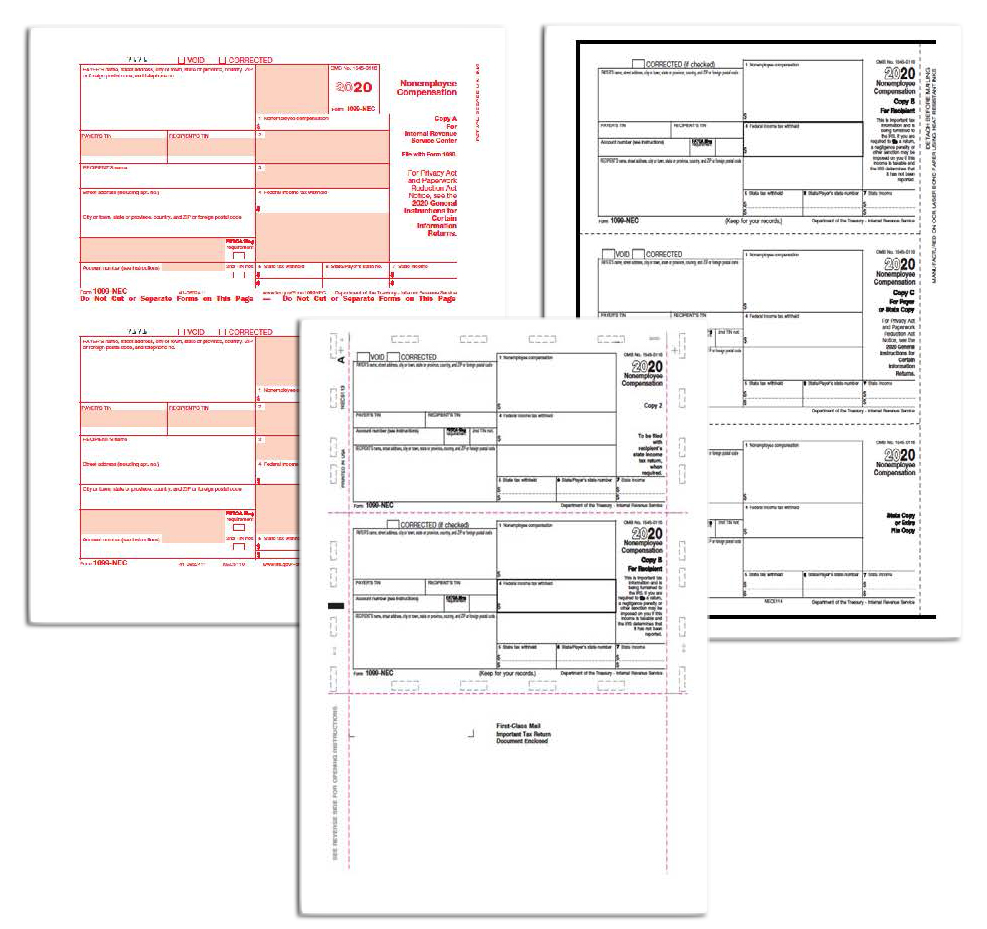

Form 1099-NEC Nonemployee Compensation, Recipient Copy B

When filing these forms, it is essential to provide copies to the individuals or entities who received payments. This helps them accurately report their income when filing their own tax returns.

Form 1099-NEC includes a recipient copy, known as Copy B, which must be provided to the non-employee. This copy serves as a record for the recipient to reference when filing their taxes. It’s important to ensure that the recipient receives this copy by the January 31 deadline.

Form 1099-NEC includes a recipient copy, known as Copy B, which must be provided to the non-employee. This copy serves as a record for the recipient to reference when filing their taxes. It’s important to ensure that the recipient receives this copy by the January 31 deadline.

Form 1099 Nec Pdf Fillable

Preparing and filing tax forms can be overwhelming, but fortunately, there are resources available to simplify the process. One such resource is the fillable PDF version of the Form 1099-NEC.

The fillable PDF version allows you to easily input the required information and generate a professional-looking form. This makes the process more efficient and less prone to errors. Make sure to save a copy for your records and provide the necessary copies to recipients.

The fillable PDF version allows you to easily input the required information and generate a professional-looking form. This makes the process more efficient and less prone to errors. Make sure to save a copy for your records and provide the necessary copies to recipients.

Tax Print-Forms For 1099-NEC and 1099-MISC Withholding Tax Return

Completing your tax obligations requires attention to detail and accuracy. To ensure compliance, consider using tax print-forms specifically designed for forms 1099-NEC and 1099-MISC.

These print-forms provide clear and concise instructions to guide you through the process of completing and filing the forms correctly. They help ensure that you report all relevant information accurately and avoid any unnecessary penalties.

These print-forms provide clear and concise instructions to guide you through the process of completing and filing the forms correctly. They help ensure that you report all relevant information accurately and avoid any unnecessary penalties.

2021 Form IRS 1099-NEC Fill Online, Printable, Fillable, Blank

Another convenient option for completing and filing the Form 1099-NEC is to utilize online platforms. One such platform is pdfFiller, which allows you to fill out the form online, print it, and submit it electronically.

This streamlined process saves time and effort. You can complete the form online, ensuring accuracy, and eliminate the need for handwritten forms. Make sure to review your entries carefully before submitting your final form.

This streamlined process saves time and effort. You can complete the form online, ensuring accuracy, and eliminate the need for handwritten forms. Make sure to review your entries carefully before submitting your final form.

1099-NEC Form 2021

With the reintroduction of the 1099-NEC form, it’s crucial to familiarize yourself with its layout and structure.

Understanding how to complete this form correctly will help you accurately report nonemployee compensation and avoid any potential filing issues.

Understanding how to complete this form correctly will help you accurately report nonemployee compensation and avoid any potential filing issues.

How To Fill Out A 1099 Nec Form By Hand

If you prefer the traditional approach of completing tax forms by hand, it’s important to do so accurately and legibly.

Ensure that you use a pen or ink that won’t smear or fade over time, as these forms are critical for tax record-keeping. Take your time and double-check all entries to minimize errors and potential discrepancies.

Ensure that you use a pen or ink that won’t smear or fade over time, as these forms are critical for tax record-keeping. Take your time and double-check all entries to minimize errors and potential discrepancies.

Form 1099-NEC for Nonemployee Compensation

The Form 1099-NEC is a vital tool for accurately reporting nonemployee compensation.

By using this form, you enable the IRS to track payments made to non-employees, ensuring the transparency and fairness of the tax system. Compliance with this reporting requirement is essential to avoid potential penalties and maintain your tax obligations.

By using this form, you enable the IRS to track payments made to non-employees, ensuring the transparency and fairness of the tax system. Compliance with this reporting requirement is essential to avoid potential penalties and maintain your tax obligations.

In conclusion, staying ahead of your tax obligations is crucial for both individuals and businesses. By being aware of the deadlines for filing forms 1099-MISC and 1099-NEC and utilizing available resources, such as fillable PDFs, tax print-forms, and online platforms, you can simplify the reporting process and ensure accuracy. Remember to review your entries carefully, provide recipient copies, and stay informed about any upcoming changes to these tax forms. By fulfilling your tax obligations accurately and in a timely manner, you can maintain compliance with the IRS and avoid unnecessary penalties.